St. Louis, Missorui is home to a housing market that’s constantly rising. Many Americans from Florida, California, and Illinois are flocking to the Show-Me state for more affordable prices.

If you’re interested in a St. Louis property, you’ll need to secure a loan from a St. Louis mortgage and home loans company. But what do interest rates look like, and how streamlined is the process? With The Home Loan Expert’s professionalism, you can bet on a no-nonsense home loan managed by experienced professionals with a strong background in Missouri real estate.

Today, we’ll cover popular St. Louis neighborhoods, average home prices, the best mortgage lenders, and loan options for both experienced and first-time homebuyers. Stay tuned—homeownership in St. Louis is attainable with the proper knowledge, support, and loans!

Buying a Home in St. Louis

Any St. Louis mortgage and home loans company will tell you the same thing about the St. Louis market: it’s hot. Not unlike other U.S. capitals, St. Louis has seen steady increases in home prices without an accompanying supply increase. What does that mean for prospective buyers?

Many St. Louis homebuyers offer at least $10,000 over asking price, while real estate prices in St. Louis ranging from $5K (for a small lot) to over eight million. The middle-ground? About $189K–which is much less than the national average.

St. Louis Real Estate

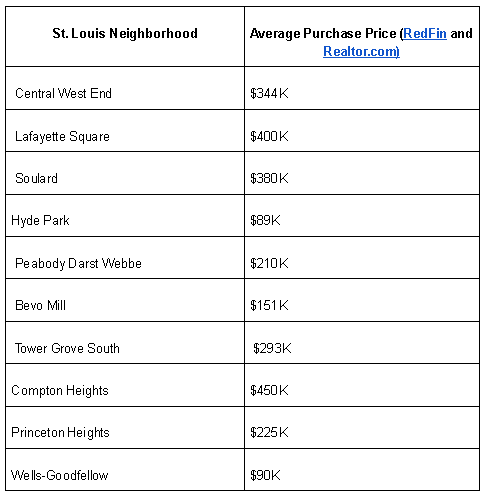

While $189k is the city’s average, St. Louis has 74 neighborhoods, all with varying housing prices.

Best Home Loan Mortgage Options in St. Louis

How much are you comfortable with in terms of interest rates? What’s your budget for monthly payments? These are questions you should answer before picking a mortgage loan. Let’s take a look at some mortgage candidates:

ARM (adjustable rate mortgages):

Government-insured mortgages (FHA, VA, and USDA-backed mortgages): If you know you need a bit of support with your down payment and interest rates, a government-backed mortgage could be a great fit. You’ll pay more interest in the long run if you don’t put as much money down, but these loans XXX.

Fixed-rate mortgages: XXX

Conventional mortgages: Do you have a solid 10-20% saved for a down payment? Decent credit? You can likely score a conventional mortgage with a competitive interest rate. Essentially, any mortgage loan without special circumstances or government insurance is considered conventional.

Here at The Home Loan Expert, we know how important flexibility is in home buying. Check out our full list of home loan options, all of which are available to St. Louis residents.

Top Mortgage Lenders in St. Louis

The Home Loan Expert

If you’re seeking a home loan in St. Louis, then The Home Loan Expert has you covered. The Home Loan Expert is an ever-reliable portal for your home-owning journey, boasting a seamless online experience and a plethora of options for mortgages and home loans.

Because we understand that the process can be a little overwhelming, our top priority is to keep things as easy and stress-free as possible, starting with our loan application.

The Home Loan Expert values professionalism and expertise. Our experienced consultants are well-versed in the real estate industry, especially in the St. Louis market.

Loans & Services:

- Adjustable-Rate Mortgages

- Bank Statement Mortgages

- Cash-Out Refinance

- Conventional Loans

- Debt Consolidation

- FHA Loans

- First Responder Loan Program

- Fixed-Rate Loans

- Home Purchase Loan

- Jumbo Home Loans

- No Income Verification Loans

- Union Loans

- USDA Loans

- VA Loans

- Zero Dollar

Pros:

- Personalized and hands-on service.

- Casual yet professional atmosphere — it’s like working with a friend who’s also a home loan expert.

- Most competitive closing costs in St. Louis

- Wide range of accessible and personalized loan and mortgage options

- Robust down payment assistance options

Cons:

- Perhaps too many options — we offer so many loan types that you might need a little extra time to assess each one for your unique needs.

Minimum down payment: Ranging from 3% to 0% (for VA members)

Get approved with The Home Loan Expert today!

Hero Loan

Are you an active or retired military professional? Your first choice for mortgage loans is a St. Louis mortgage and home loans company that rewards you for your service. Hero Loan is one of the fastest-growing lending platforms in the country for:

- Active-duty military

- Veterans

- Military families

We applaud Hero Loan for its mission to support veterans, including veteran-owned businesses and events.

Hero Loan is a direct-endorsed VA Lender that not only offers VA loans, but also guarantees a 14-day closing. To put things in perspective, most lenders need up to 60 days. The professionals at Hero Loan underwrite all VA loans in-house, meaning lower mortgage rates and no upfront or out-of-pocket costs—that includes the appraisal.

How it Works:

Hero Loan’s most famous loan type is the VA loan. But they don’t stop there when it comes to streamlined loan types for different borrowers:

- VA Streamline Refinancing

- Conventional Loan Refinancing

- VA Cash-Out Refinancing

- FHA Loans

Once you decide on a mortgage, you can use their website to fill out a few preliminary details and apply for the loan. After that, you’ll receive one-on-one service from a dedicated loan officer. They’ll walk you through their process and explain all the necessary details to bring you closer to your goal of homeownership.

Veterans might not have the means or expertise to address all the paperwork necessary to obtain a VA loan. Hero Loan takes care of all the busy work by filling out the documents for every client and helping them secure the all-important VA Loan Certificate of Eligibility. Fast forward 14 days, and you have a mortgage loan.

Pros:

- Full service for VA paperwork

- In-house underwriting for all VA loans

- Maximum 14-day closing for all VA loans

- Zero fees for appraisals or anything out-of-pocket

Cons:

- Services aren’t accessible unless you’re active-duty military, a veteran, or a related family member.

Minimum down payment:

$0 down payment

Golden Oak Lending

Golden Oak Lending is a renowned mortgage lender in the St. Louis area with fantastic reviews, specifically about its customer service standards and refinancing program. However, this lender doesn’t limit loan types to refinancing. You can access many different loan types with one dedicated loan officer to streamline your search.

The lender offers various loan services, including home equity loans with competitive rates.

Loans & Services

- Conventional loans

- FHA Loans

- Jumbo Loans

- Home Equity Loans

- New-Home Loans

- USDA Refinancing

- VA Loans

Pros:

- Attentive customer service

- Competitive interest rates

- Fast pre-approval

Cons:

- Limited transparency regarding loan terms and fees

Minimum down payment:

Not listed.

BMO Harris Bank

![]()

BMO Harris Bank is the 8th largest bank in North America, providing commercial and personal banking, investment services, and wealth management to over 12 million customers, including thousands in St. Louis, Missouri.

BMO Harris works with government agencies and community organizations to provide prospective homebuyers with a wide range of affordable mortgage loans. They offer competitive down payment assistance and various conventional mortgages with varying interest rates.

However, you won’t have much luck applying for conventional mortgages unless your credit score surpasses 700.

Loans & Services

- Home Equity Line of Credit, both variable and fixed-rate

- Home Equity Loans

- Mortgages

- Personal Line of Credit

- Personal Loans

Pros:

- Named One of the World’s Most Ethical Companies by the Ethisphere Institute

- No application fees

Cons:

- Borrowers need a high credit score of at least 700.

- Home equity loans are not available for investment properties or second homes.

Minimum down payment:

Not listed

Refinancing Solutions for St. Louis

Maybe you’re not a first-time homebuyer. If you already have a property in St. Louis, congrats! You likely snuck in before the market skyrocketed! We think you should be rewarded for it, and refinancing with a home equity loan does just that. Need extra cash for college tuition or renovations? You’ve built some equity in your home, and it’s likely appreciated – use it!

There are countless benefits to refinancing your home loan. You can take advantage of a lower interest rate, free yourself from PMI, consolidate debt, and fund your latest renovation.

Read here for the best home equity loan mortgage lenders in St. Louis.

Best Mortgage Brokers in St. Louis

Brokers can be a good resource for comparing multiple lenders at one time. Just be vigilant, though. It’s in a broker’s best interest to promote and push a lender with whom they have a commissioned agreement.

Similarly, brokers get paid when you sign up for a mortgage—they might push you toward something prematurely despite it not being a great fit. If you keep these considerations in mind, you could benefit from using a St. Louis mortgage broker.

Mortgage Solutions of St. Louis

Twin brothers with accounting and mortgage backgrounds run Mortgage Solutions of St Louis. With over 20 years of experience in home loans, this brokerage takes a personalized approach to every deal.

The brokerage features mortgages from 20 different national lenders and regularly trains staff on the latest trends in underwriting, real estate, and interest rates.

Loans & Services

- VA Loans

- FHA Loans

- USDA Loans

- Conventional Mortgages

- Refinancing

Delmar Mortgage

Delmar Mortgage is a licensed brokerage for 34 different states, including Missouri. Serving St. Louis since 1966, Delmar boasts a long line of experience. Although the broker doesn’t list rates for their partners, the website describes them as “competitive.”

Loans & Services

- Conventional Mortgages

- FHA Loans

- VA Loans

- Adjustable-Rate Mortgages

- Interest-only Mortgages

- Refinancing and HELOCs

Northmarq

Northmarq provides a problem-solving lens for all services. They have over 7,000 serviced loans and over 500 capital sources under their belt to give you a solid array of mortgage options.

Loans & Services

- Inquire within.

St. Louis Mortgage Calculators

Are you thinking about your budget for monthly payments? You’re not the only one – that’s why mortgage calculators exist to help you visualize your payments. They break down taxes, insurance, principal, interest, and HOA fees, so you don’t have to.

All you have to do is play around with the numbers. Try out different down payment options and assess how that affects your monthly payments.

Are you comparing different mortgages? Our goal is to provide clients with every tool possible to inform one of the biggest decisions they’ll ever make! You might like our loan comparison calculator, rent vs. buy calculator, and refinance calculator, among others. And if you have any questions about your calculations, just ask.

The Home Loan Expert in St. Louis

We provide St. Louis mortgage services in:

- Central West End

- Soulard

- Hyde Park

- Lafayette Square

- Peabody Darst Webbe

- Bevo Mill

- Princeton Heights

- Wells-Goodfellow

- Compton Heights

- Tower Grove South

Our home loan options in St. Louis include:

- Adjustable-Rate Mortgage

- Bank Statement Mortgage and No-Income Verification Loans

- Cash-out Refinance

- Conventional Loan

- FHA Loan

- Debt Consolidation

- First-Responder Loan Program

- Fixed-Rate Loans

- Home Purchase Loans

- Jumbo Home Loan

- Rate and Term Refinance

- Refinance

- Teacher Appreciation Program

- Union Loan

- USDA Loan

- VA Loan

- Zero Dollar Down Loan

Our St. Louis Story

In St. Louis, Ryan Kelley, The Home Loan Expert, has worked since 2004 to ensure that every family, regardless of their means or situation, has access to the lowest rates available for their home mortgage loans.

Whether they are looking to refinance or purchase a new home, these loans, from FHA, HARP, VA, USDA, to Jumbo, will be available for families to use as they need. Many families like to refinance for debt consolidation, pay for student or vehicle loans, or do repairs or updates to their homes.

They can also refinance to lower their monthly payments or shorten the length of their mortgage loan agreements. Sometimes, we’re able to accomplish all of these at once!

Whether you’re looking to purchase a new home or refinance one in St. Louis, St. Charles, Clayton, Ladue, Wentzville, O’Fallon, Creve Coeur, Kirkwood, Maryland Heights, Richmond Heights, Fenton, Ellisville, or across the river in Illinois, in Edwardsville, Collinsville, Glen Carbon, Fairview Heights, O’Fallon, Swansea, Alton, or Belleville, Troy, or anywhere in St. Louis and the surrounding areas, give us a call or apply online at www.thehomeloanexpert.com.

Ryan Kelley

The Home Loan Expert

800-991-6494